What is a DSCR Loan and How Can It Benefit Real Estate Investors?

What is a DSCR Loan and How Can It Benefit Real Estate Investors?

Financing options play a crucial role in determining an investor's success. Among these options, DSCR financing has emerged as a powerful tool for real estate investors looking to expand their portfolios. This comprehensive guide will explore the ins and outs of DSCR loans, their benefits, and how they compare to traditional financing options.

Introduction to DSCR Loans

DSCR loans, or debt service coverage ratio loans, are a type of financing specifically designed for real estate investors. Unlike traditional mortgages that primarily focus on the borrower's personal income and credit score, DSCR financing evaluates the income-generating potential of the property itself.

Key features of DSCR loans include:

Focus on property's cash flow rather than borrower's personal income

Typically used for investment properties, including multi-family units and commercial real estate

Often offer more flexible qualification criteria compared to conventional loans

Can be used for purchases, refinances, or cash-out refinances

The fundamental principle behind DSCR loans is simple: if the property generates sufficient income to cover its expenses and debt payments, it's considered a good candidate for financing, regardless of the borrower's personal financial situation.

2. How DSCR is Calculated

Understanding how the Debt Service Coverage Ratio is calculated is crucial for investors considering DSCR financing. The DSCR is a measure of the property's ability to cover its debt obligations with its net operating income.

The basic formula for DSCR is:

DSCR = Net Operating Income (NOI) / Total Debt Service

Let's break down each component:

Net Operating Income (NOI): NOI = Gross Rental Income - Operating Expenses

Gross Rental Income: Total annual rental income from the property

Operating Expenses: All costs associated with running the property (excluding debt payments), such as:

Property taxes

Insurance

Maintenance and repairs

Property management fees

Utilities (if not paid by tenants)

Total Debt Service: This includes all debt payments related to the property, including:

Principal and interest payments on the loan

Any other liens or loans against the property

For example, let's consider a property with the following annual figures:

Gross Rental Income: $100,000

Operating Expenses: $40,000

Annual Debt Service: $50,000

Calculation:

NOI = $100,000 - $40,000 = $60,000

DSCR = $60,000 / $50,000 = 1.2

In this case, the DSCR is 1.2, meaning the property generates 20% more income than is needed to cover its debt obligations.

Most lenders require a minimum DSCR of 1.25 for DSCR financing, though this can vary depending on the lender and the specific property type. A higher DSCR indicates a lower risk for the lender and may result in more favorable loan terms for the borrower.

3. Benefits of DSCR Loans

DSCR loans offer several advantages that make them particularly attractive to real estate investors:

Easier Qualification: Because DSCR financing focuses on the property's income rather than the borrower's personal income, it can be easier to qualify for, especially for investors with multiple properties or complex income structures.

Larger Loan Amounts: DSCR loans often allow investors to borrow larger amounts compared to traditional loans, as the property's income potential is the primary consideration.

Scalability: As DSCR loans don't rely on personal income, investors can potentially finance multiple properties without the limitations often imposed by debt-to-income ratios in conventional loans.

Flexibility: DSCR financing can be used for various property types, including multi-family units, commercial properties, and even short-term rental properties in some cases.

Faster Approval Process: Since the focus is primarily on the property's financials rather than the borrower's personal finances, the approval process for DSCR loans can often be quicker than traditional mortgages.

No Income Verification: For many investors, especially those with complex income structures or self-employment, the lack of personal income verification can be a significant advantage.

Potential Tax Benefits: Interest on loans for investment properties is often tax-deductible, potentially offering tax advantages to investors using DSCR financing.

Cash-Out Options: Many DSCR loan programs offer cash-out refinance options, allowing investors to tap into their property's equity for further investments or improvements.

These benefits make debt service coverage ratio loans an attractive option for many real estate investors, particularly those looking to grow their portfolios efficiently.

4. DSCR Loans vs. Traditional Loans

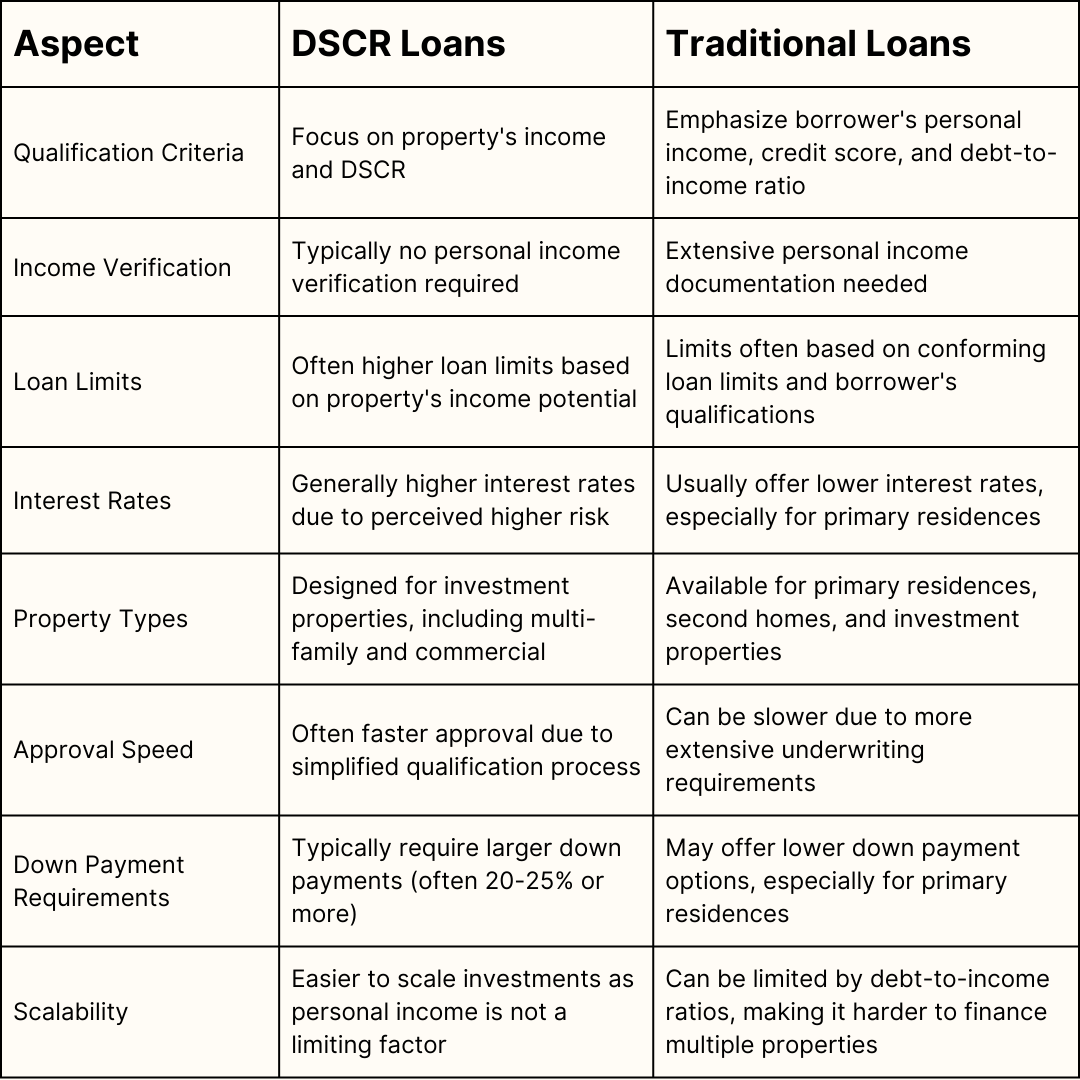

To fully appreciate the advantages of DSCR financing, it's helpful to compare them with traditional loan options:

While DSCR loans offer distinct advantages for real estate investors, they may not be the best choice for every situation. Investors should carefully consider their specific needs and circumstances when choosing between DSCR financing and traditional loan options.

5. How to Apply for a DSCR Loan

If you're considering DSCR financing for your next real estate investment, here's a step-by-step guide to the application process:

Prepare Property Information:

Gather details about the property, including purchase price, expected rental income, and operating expenses

Compile recent rent rolls and lease agreements if the property is already generating income

Prepare a pro forma statement if it's a new investment

Calculate the DSCR:

Use the formula discussed earlier to calculate the property's DSCR

Ensure the DSCR meets the minimum requirements of potential lenders (typically 1.25 or higher)

Research DSCR Lenders:

Look for lenders specializing in DSCR loans

Compare terms, interest rates, and fees from multiple lenders

Gather Required Documentation:

Property details and purchase agreement (if applicable)

Rent rolls and lease agreements

Property operating statements

Personal financial statement

Business entity documents (if applying as an LLC or corporation)

Submit Loan Application:

Complete the lender's application form

Provide all required documentation

Pay any applicable application fees

Property Appraisal and Inspection:

The lender will typically order an appraisal to verify the property's value

An inspection may be required to assess the property's condition

Underwriting Process:

The lender reviews all documentation and assesses the property's financials

They may request additional information or clarification during this stage

Loan Approval and Closing:

If approved, review the loan terms carefully

Coordinate with the lender to schedule the closing

Prepare for any closing costs or fees

Remember, while the process for DSCR loans is often simpler than traditional mortgages, it's still important to be thorough and responsive throughout the application process.

6. Conclusion and Recommendations

DSCR financing offers a valuable alternative to traditional loans for real estate investors. By focusing on a property's income potential rather than the borrower's personal finances, debt service coverage ratio loans can provide greater flexibility and scalability for building a real estate portfolio.

Key takeaways about DSCR loans include:

They prioritize the property's ability to generate income

They can be easier to qualify for, especially for investors with multiple properties

They often allow for larger loan amounts compared to traditional financing

They can streamline the approval process for experienced investors

However, it's important to remember that DSCR loans typically come with higher interest rates and larger down payment requirements compared to traditional mortgages. Investors should carefully weigh these factors against the benefits when deciding on the best financing option for their situation.

Recommendations for investors considering DSCR financing:

Do Your Homework: Thoroughly research potential properties and their income potential before applying for a DSCR loan.

Improve Your DSCR: Look for ways to increase a property's NOI or reduce its operating expenses to improve its DSCR and qualify for better loan terms.

Shop Around: Compare offers from multiple DSCR lenders to find the best terms and rates for your situation.

Consider Long-Term Strategy: Think about how DSCR loans fit into your overall investment strategy and portfolio growth plans.

Seek Professional Advice: Consult with a real estate attorney or financial advisor to ensure DSCR financing aligns with your investment goals and risk tolerance.

DSCR loans can be a powerful tool for real estate investors looking to expand their portfolios efficiently. By understanding how these loans work and their potential benefits, investors can make informed decisions about whether DSCR financing is the right choice for their next investment opportunity.

Are you ready to explore DSCR financing options for your real estate investments? Contact HIS Capital Funding today to learn more about our DSCR loan programs and how we can help you achieve your investment goals.